Days after the arrest of 3C’s Director the EOW has went on to burst the whip on director of the...

It has only been a fortnight since the first hearing of the newly formulated western UP RERA Authority in Noida...

Finally, the Real Estate regulation and Development Authority of Punjab has woken up to the plights of homebuyers. The authority...

On the first seating the Greater Noida bench of the UP-RERA heard 31 complaints all against a Noida-based developer that...

The newly formulated UPRERA bench at greater Noida will become functional from 4th September and already has 4000 complaints filed...

The Chairman of RERA Bihar Mr. Afzal Amanullah recently sent a letter to the state government urging them to direct...

Speaking at CII-CBRE Real estate conference minister for housing and urban affairs Mr. Hardeep Singh Puri stated that the legislature...

A conference was held on Monday where the Gurugram RERA authority president Mr. K.K Khandelwal was the guest of honor....

The state government of BIHAR in its cabinet meeting has decided that ongoing projects which are not registered with the...

Maharashtra RERA Authority has brought a sigh of relief for the homebuyers of PADMANABH which was being promoted and developed...

Tamil Nadu Real Estate Regulatory Authority (TNRERA) has secured eighth position among the states having the authority wherein it has...

The state of Uttar Pradesh has brought a sigh of relief for the aggrieved homebuyers of Noida by formulating a...

The Real Estate Regulatory Authority in Karnataka has come under fire from the aggrieved home buyers who have been left...

The state government of Karnataka is yet to wake up from slumber as the homebuyers struggle to get justice against...

Gujarat is among the top states in implementation and adoption of new realty law in the country. The state Gujarat...

Crime branch team on Sunday has arrested the senior vice president of Earth Iconic Infrastructure Private Limited. The accused has...

For almost a year the state of Uttar Pradesh had the post of RERA chief vacant hampering the functionality and...

Thursday brought happy news to around 4300 Amrapali homebuyers who have been left midway due to the ongoing insolvency proceedings...

The division bench of Rajasthan High court stayed the order passed by the RERA Appellate Tribunal as it was not...

In a fascinating order, the Maharashtra Real Estate Regulatory Authority (MahaRERA) Appellate Tribunal has revealed a cooked up story of...

Unitech received a huge amount from the homebuyers at the time of booking the units in Fresco Apartments. The residents...

As per the procedure established, the relators are required to hand over the unit to the homebuyers on time. If...

Real Estate (Regulations and Development) Act, 2016 came into force on 1st of May in 2017, to cleanup the mess...

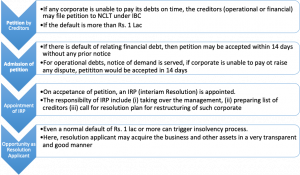

A paper by industry lobby Assocham surmise that the Insolvency and Bankruptcy Code and the Real Estate (Regulation and...

The (Punjab RERA) Punjab Real Estate Regulatory Authority has issued notices to nearly 50 developers for not registering themselves and...

Now agents and developers can file their complaint on RERA (Real Estate Regulation Act) website directly. The website with its...

Jaypee Group has said that there is no wrong doing on the unencumbered land of the group in favor of...

Gurgaon RERA: H-RERA (Haryana Real Estate Authority) after four months of wait nominated the chairpersons and members of authority on...

An audit of 14 housing projects in Noida, concluded by the international firm M/s Currie and Brown found that amount...

The MahaRERA has imposed penalties ranging from 2 lakhs to 12 lakhs on six developers for not following the obligations...

After facing a lot of criticism for leaving almost 90% of the residential projects going on in the city outside...

Gurgaon: On 29th July 2017, Haryana Government passed RERA in Haryana. But, the website for the RERA Registration in Haryana...

G Jagadeesha, commissioner, Mysuru City Corporation on Tuesday said, only five Completion Report’s (CR) issued of the Real Estate Regulation...

A Real Estate Forum has been formalized by the MahaRera in association with Confederation of Real Estate Developers’ Associations of...

The Haryana Government nominated two members each for the twin H-RERA benches in Panchkula and Gurugram. Where, Rtd. District and...

A new reconciliation forum launched by MahaRERA to address complaints of both developers and buyers. Now, Citizens can file an...

The appointment of chairperson and two members on Tamil Nadu Real Estate Regulatory Authority (TNRERA) is going to happen soon....

An IT project has been deliberately united with the objectives of the Kerala state government to grow competitive and vivacious...

TNRERA’s (Tamil Nadu Real Estate Regularity Authority) has generated the data of 186 Real Estate Agents and all of those...

Maha RERA : Regardless of expanding deadlines, hardly 12 percent property dealers in Maharashtra have enrolled under the MahaRERA, the...

The real estate industry in the year of 2017 was remarkable and very challenging because of various changes like RERA,...

GOA RERA: The RERA Act is aimed at monitoring the projects being developed by and builders at same time. It...

RAJRERA: The Rajasthan Authority imposed penalty upon 4 builders for violating the norms of the Act’ 2016. While, Ginni homes...

GHAZIABAD: The principal secretary of housing and urban planning and the interim chairman of Real Estate Regulatory Authority (RERA) went...

Cases of Civil nature doesn’t fall in RERA MAHARERA: Chitra Singh, gazal singer Jagjit Singh's widow and her grandson Armaan...

MAHARERA: By virtue of the powers presented by the first provision to sub-section (4) of section 43 of Real Estate...

GHAZIABAD: Nearly 250 manufacturers have outfitted fragmented data on UP Rera site and that all improvement experts have been told...

Haryana Real Estate Regulatory Authority (HRERA-situated at Panchkula) which is constituted under Real Estate (Regulation and Development) Act 2016 and...

The RERA authorities in state of Karnataka placed in the capital city of Bengaluru have come to the rescue of...

From the introduction of the Real Estate Regulation and Development Act (RERA), the real estate sector has seen some deep...

The ongoing projects developed in rural areas of Rajasthan to be covered under the Real Estate Regulation and Development Act...

A Central Advisory Council (CAC) has been set up by the Central government for effectual implementation of the Real Estate...

For last 7 years, the real estate in Hyderabad has been in inactive stage which is now seeing an increment...

Jaypee infra set one’s sight on delivering its 5,100 flats and apartments by March 2018 from the ongoing tussle with...

The outbreak of the Real Estate Regulation and Development Act (RERA) and Goods and Services Tax (GST) has created such...

Setting up of the Real Estate Regulation and Development Act (RERA) Authority lags in Hyderabad which has somehow came as...

The Ministry of Corporate Affairs (MCA) has moved straight out to take over the management of renowned Unitech Company considered...

The real estate market witnessed stoppage post the Real Estate Regulation and Development Act (RERA) but the market has started emerging...

Since there has been slowdown in the registration of layouts and projects under the Real Estate Regulation and Development Act...

NEW DELHI: The housing and urban affairs ministry has constituted a 30-member central advisory council, which will play key role...

Regulatory reforms brought through the Real Estate Regulatory Act (RERA)and transparency brought about by Goods and Services Tax (GST) will...

DEHRADUN: The Real Estate Regulatory Authority (RERA) has served 31 notices to builders, most of them from Dehradun, over complaints...

The state government seems to have clipped the wings of the Gurugram Bench of the Real Estate Regulatory Authority (RERA),...

NASHIK: As many as 904 new and ongoing real estate projects in Nashik region, including 726 projects in Nashik city,...

Mumbai: Home loan interest rates have dipped, but buyers’ sentiments have not improved, data shows, leading to a sharp fall in...

Implementation of Real Estate (Regulation and Development) Act, 2016 will boost the Non-Resident Indian sentiments on Indian real estate sector,...

The matters related to the administration of the RERA for regulation of the real estate sector and to protect the...

JAIPUR: The Rajasthan Housing Board (RHB), a government agency which infamous for poor quality construction in the state still remains out of...

Mumbai: The RERA (Real Estate Regulatory Authority) appellate tribunal will be formed in next two months, confirmed a RERA official. Nineteen...

AHMEDABAD: Happening for the first time in Ahmedabad exclusively of RERA registered projects, The Times Real Estate Expo kick starts on Saturday at The...

PUNE: The Maharashtra Real Estate Regulatory Authority (MahaRERA) will, from January 2018, provide consumers with the conciliation option on its website before...

GURUGRAM: Developers have come to the rescue of thousands of residents who have recently moved into new sectors (58-115). With...

NEW DELHI: Realty major DLF sold housing properties worth of about Rs 300 crore in Gurgaon in November when it reopened...

NEW DELHI: The Centre will announce the next set of 10 cities for funding under the Smart City Mission by January-end, a...

VISAKHAPATNAM: In major relief to property buyers, especially apartments, Goods and Sales Tax (GST) authorities have warned realtors and construction companies of...

MUMBAI: The housing finance companies’ regulator National Housing Bank is in talks with the authorities to lower the effective Goods & Services...

MUMBAI: The housing finance companies’ regulator National Housing Bank is in talks with the authorities to lower the effective Goods & Services...

Maharashtra Real Estate Regulatory Authority (MahaRERA) has dismissed a complaint from a home buyer against India Bull Real Estate Ltd for delayed possession ruling...

NEW DELHI: The National Green Tribunal has directed that no ready-mix plants will be permitted to operate at construction sites in Noida without...

Mumbai: The landmark ruling of the Bombay High Court upholding the constitutional validity of the Real Estate Regulatory Authority (RERA) act...

MUMBAI: Realty developers’ body Confederation of Real Estate Developers' Associations of India (CREDAI), through a letter to Hardeep Singh Puri, Minister for Housing...

MUMBAI: The Maharashtra Real Estate Regulatory Authority has for the first time expanded the scope of reasons beyond a builder’s control. The...

Bombay High Court (File photo)MUMBAI: The Bombay High Court has passed a remark, while dismissing builders’ plea against the constitutional validity of RERA, that...

The corporate affairs ministry has now sought time till Wednesday to respond and take instructions on how to protect home...

PUNE: The Maharashtra Real Estate Regulatory Authority (MahaRERA) will, from January 2018, provide consumers with the conciliation option on its website before...

New Delhi: The Supreme Court on Wednesday stayed an order of the National Company Law Tribunal (NCLT) that allowed the government...

Karnataka Real Estate Regulatory Authority (RERA) has crooked 20 housing projects of developers. The list of developers whose housing projects...

Bombay High Court on Thursday ruled out that all incomplete and ongoing projects to come under the Real Estate Regulatory...

As per a recent order by Bombay High Court upholding constitutional validity of the Real Estate Regulation and Development Act (RERA)...

Recently, Bombay High Court reviewed the project completion rules under Maharashtra Real Estate Regulation and Development Act (MahaRERA). A remark...

Though Indian real estate sector is facing ups and downs with the implementation of government’s initiative the Real Estate Regulation...

Maharashtra Real Estate Regulatory Authority (MahaRERA) has announced that landowners, investors having an area or revenue share in real estate...

The possession of flats booked by homebuyers can’t be delayed. The apex consumer commission has said as it asked a...

Bombay High Court is upholding the constitutional validity of the Real Estate Regulation and Development Act (RERA) intimating that “ongoing...

Section 46 of the Real Estate Regulation and Development Act (RERA) which deals with the engagement of members of RERA...

State authorities that diluted the definition of ongoing projects in the real estate sector under the Real Estate Regulation and...

Haryana government has set up a panel to head the Real Estate Regulation and Development Act (RERA) in Gurugram and...

Maharashtra Real Estate Regulatory Authority (MahaRERA) alleged that builders cannot blame the system to seek exemption from paying rectification to...

The Bombay High Court on Wednesday preserved the legitimateness of the Real Estate Regulation and Development Act (RERA), 2016 for...

Haryana Real Estate Regulatory Authority (HRERA) has sent notices to 160 real estate builders in Haryana for filing incomplete applications...

A national database of all housing projects is to be created by the Housing and Urban Affairs Ministry. The idea...

In protest against builders under the Real Estate Regulatory Authority (RERA) consumers established their own forum “Fight for RERA” comprising...

Uttar Pradesh (UP) Government set up a group of ministers to scrutinize the disarray in Noida's real estate sector. The...

Reserve Bank of India (RBI) has alleged corporative societies not use the word 'Bank' in their names as it violates...

Uttar Pradesh Real Estate Regulation and Development Act (UPRERA) once and for all will now have its own office. This...

Supplementary housing projects which were earlier exempted from Tamil Nadu Real Estate Regulation and Development Act (TNRERA) are now on...

The crunch in the real estate sector has intensified, as the Income Tax Department is all set to an excise...

Flat buyers in Mumbai are now moving to High Court in the absence Real Estate Regulation and Development Act (RERA)...

Builders in Punjab are marketing their projects without getting them registered under the Real Estate Regulation and Development Act (RERA)...

Tamil Nadu has seen the registration of 223 housing projects under Real Estate Regulation and Development Act (RERA) until November...

Maharashtra Real Estate Regulatory Authority (MahaRERA) laid off a complaint of a home buyer seeking refund of his money after...

Since Real Estate Regulation and development Act (RERA) came into force i.e. 01/05/2017, it was made mandatory for real estate...

Recently, as per a property report number of unsold housing units lapsed to 6.85 Lakh across 7 cities. The national...

Mumbai: Bombay high court on Thursday directed Runwal Homes to deposit Rs 1.74 crore if it wanted a refund order passed by Maharashtra Real...

MANGALURU, NOVEMBER 10: Real estate sector has expressed concern over the penal provisions in the Karnataka Real Estate Regulatory Authority...

The push for under-construction projects comes at a time when most real estate firms are focusing on ready properties after...

The interim Haryana Real Estate Regulatory Authority (H-RERA) has slapped notices on 140 residential projects across the state for "not applying" for registration under...

As per recent statistics the real estate sector is fenced in a big jam. Over 6 Lac houses are running...

Mr. Mukul Singhal, chairman of RERA in Uttar Pradesh, who is also the principle secretary of Housing and urban planning...

Real Estate Regulation Rules (RERA) framed under REDA Act was enacted by government that came force into effect from May...

First legal step for non-registration in RERA Act 2016 has been taken in Maharashtra. Sai Estate Consultant of Maharashtra has...

Among many harsh provisions for builders, Maha-RERA relief to builder community is on its last phase. Now the developers in...

Whether deliberately or not the Karnataka Government is still failing to come to any conclusion regarding the implementation of RERA...

The Uttar Pradesh government has rewritten the real estate regulation rules, doing away with pro-developer clauses that diluted the countries...

As Real Estate Regulation and Development Act 2016 came into force across India, Uttar Pradesh is one of the states...

The Maharashtra Real Estate Regulatory Authority (MahaRERA), take the first action on a real estate company for "misleading consumers." MahaRERA...

Under RERA, (the new realty law that aims to bring transparency and accountability to the real estate market), all property...

The State of Haryana on 28/4/2017 has issued draft set of rules for public opinion and suggestion. After 15 days,...

join For Updates

join For Updates