- Bill of Supply

Where a supplier is not required to charge any tax, he shall raise a bill of supply instead of invoice. Bill of supply will be raised by:

- A registered person supplying exempted goods or services or both or

- A registered person paying tax under the provisions of Section 10

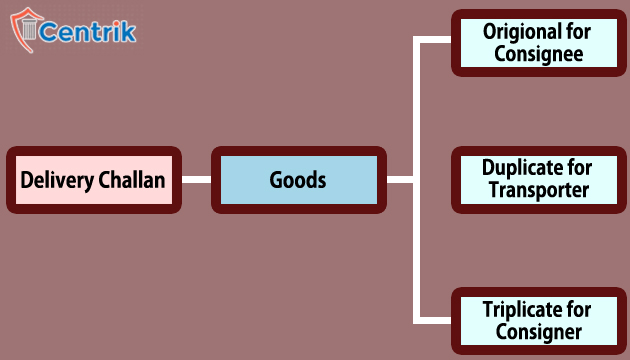

- Delivery Challan

Invoice Rules list few situations where a delivery challan, serially numbered, will be issued instead of invoice. Such situations are as follows:

- Supply of liquid gas where the quantity at the time of removal from the place of business of the supplier is not known.

- Transportation of goods for job work.

- Transportation of goods for reasons other than by way of supply, or

- Such other supplies as may be notified by the Board

3. Manner of Issuing Delivery Challan

- The supplier is required to issue a tax invoice after delivery of goods where tax invoice could not be issued at the time of removal of goods for the purpose of supply.

- Where the goods are being transported in a semi knocked down or completely knocked down condition:

- The supplier shall issue the complete invoice before dispatch of the first consignment;

- The supplier shall issue a delivery challan for each of the subsequent consignments, giving reference of the invoice.

- Each consignment shall be accompanied by copies of the corresponding delivery challan along with a duly certified copy of the invoice; and

- The original copy of the invoice shall be sent along with the last consignment.

Note – Please note that the above article is part of our continuous research on the related matters. It is based on our interpretation of related regulations which may differ person to person. Readers are expected to take expert opinion before relying on above.

join For Updates

join For Updates