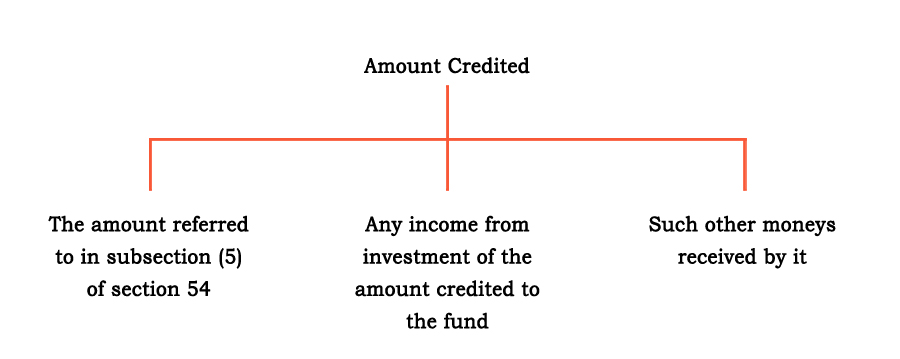

Under section 2(51) of the CGST Act, 2017, “Fund” means the Consumer Welfare Fund established under section 57. Section 57 of the CGST Act, 2017 states that the Government shall constitute a fund, to be called the Consumer Welfare Fund and the following amounts will be credited to the Fund:

All sums credited to the Consumer Welfare Fund shall be utilized by the Government for the welfare of the consumers in such manner as may be prescribed.

Refund is normally credited to the Consumer Welfare Fund constituted by the Government except under following cases, where it shall be paid to the applicant:

- Refund of tax paid on zero-rated supplies of goods or senders or both or on inputs or input services used in making such zero-rated supplies;

- Refund of unutilized input tax credit under subsection 54(3);

- Refund of tax paid on a supply which is not provided, either wholly or partially, and for which invoice has not been issued, or where a refund voucher has been issued;

- Refund of tax in pursuance of section 77;

- The tax and interest, if any, or any other amount paid by the applicant, if he had not passed on the incidence of such tax and interest to any other person; or

- The tax or interest borne by such other class of applicants as the Government may, on the recommendations of the Council, by notification, specify

The Government or the authority specified by is required to maintain proper and separate account and other relevant records in relation to the Fund and prepare an annual statement of accounts in such form as may be prescribed in consultation with the Comptroller and Auditor-General of India.

Note – Please note that the above article is part of our continuous research on the related matters. It is based on our interpretation of related regulations which may differ person to person. Readers are expected to take expert opinion before relying on above.

join For Updates

join For Updates