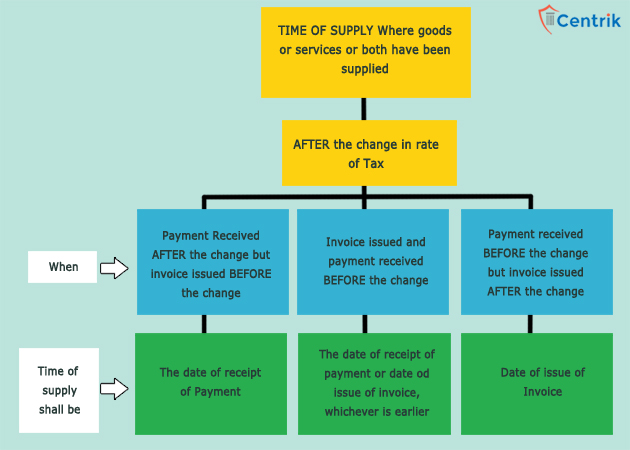

Section 14 of the CGST Act, 2017 states the time of supply, where there is a change in the rate of tax in respect of goods or services or both. In case the goods or services or both. In case the goods or services or both have been supplied after the change in the rate of tax, the time of supply can be determined as follow:

” The date of receipt of Payment” shall be the date on which the payment is entered in the books of account of the supplier or the date on which the payment is credited to his bank account, whichever is earlier.

Note – Please note that the above article is part of our continuous research on the related matters. It is based on our interpretation of related regulations which may differ person to person. Readers are expected to take expert opinion before relying on above.

join For Updates

join For Updates