In recent years, e-commerce in India has managed to capture the eye-balls and also the mind-space of the consumers at large such as never before and with this unprecedented growth, India has become the second largest market for e-Commerce. It has now become imperative for the business to understand and adopt e-commerce to grow trade in India.

In this article we will analyze the GST impact on E-commerce industry by means of changes in taxation of e-commerce along with GST guidelines for the e-commerce industry.

Overview

India has an internet user’s base of about 450 million as of July 2017, 40% of the population. Despite being the second-largest user base in world, only behind China (650 million, 48% of population), the penetration of e-commerce is low compared to markets like the United States (266 million, 84%), or France (54 M, 81%), but is growing at an unprecedented rate, adding around 6 million new entrants every month.

In India, cash on delivery is the most preferred payment method, accumulating 75% of the e-retail activities. The largest e-commerce companies in India are Flipkart, Amazon India, Snapdeal, and Paytm.

Taxability of E-Commerce

Taxability of the e-commerce transaction differs from other trade transactions. Generally, in such transactions, though the impression is that the e-commerce operator is the provider of goods/services, the actual provider of goods/ services are third-party vendors. Now these vendors may either belong to the organized or unorganized sector and may operate at different scales. Accordingly, taxability of this bunch is challenging, wherein the legislature is required to apply intelligible differentiators so as to achieve substantive equality.

Further to this objective, GST has special provisions with respect to e-commerce operators and vendors selling through them, such as, special category of return in Form GSTR-8, mandatory registration, tax collection at source from the vendors, tax payment on behalf of vendors in certain case of supplies notified under Section 9(5) of the Central Goods and Services Tax Act, 2017 (CGST Act), among others.

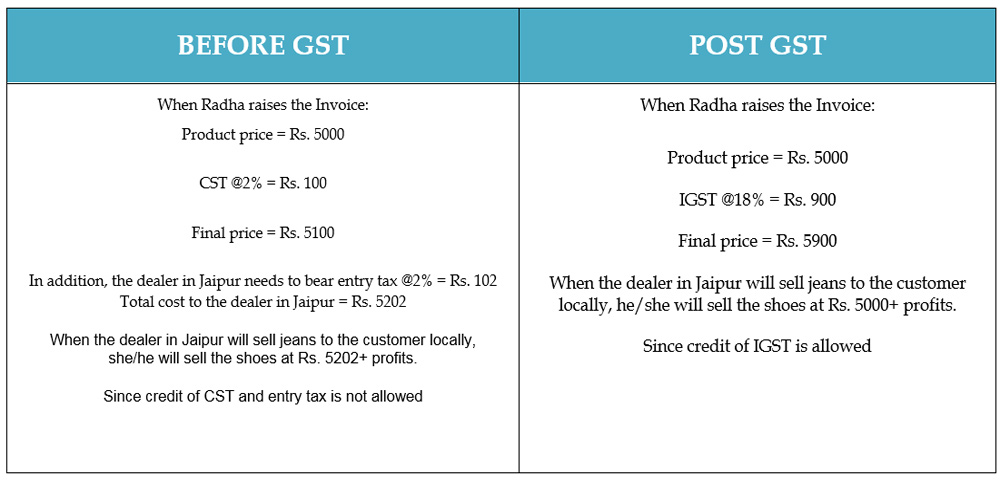

Comparative Analysis

Specific guidelines under GST for E-Commerce

The success of the e-commerce sector is largely dependent on the increasing number of retail entrepreneurs, who fall in the unorganized retail sector category. The government has included such players in the ambit of GST with an intention of broadening the tax base and has introduced specific provisions for the e-commerce companies.

Here are some of the key areas of GST that impacted the e-commerce sector:

- Mandatory Registration for E-commerce Operators and their Vendors

Under the GST regime, a specific threshold limit of aggregate turnover is prescribed for registration, i.e., INR 20 lakhs in general and INR 10 lakhs for specified States. However, the threshold limit is not applicable in case of e-commerce operators. Further, even the sellers who supply goods and/or services through an e-commerce operator are required to get registered under GST, irrespective of the threshold limit.

- No benefit of composition scheme

Sellers who are supplying goods and/or services through an e-commerce operator are not allowed to opt for composition scheme under the GST regime.

- Matching Concept and Increase in Compliances

The e-commerce operator is required to report all supplies made by the seller and the TCS collected on a monthly basis. TCS collected by the e-commerce operator from the vendors can be set-off against the overall GST liability of such vendors.

- Tax Collection at Source (TCS)

The e-commerce operator is required to collect an amount at the rate of one percent (0.5% CGST + 0.5% SGST) of the net value of taxable supplies made through it, where the consideration is collected by such operator. The amount so collected is called as TCS.

GST Council, in its 22nd Meeting held on 6 Oct. 2017 has recommended that the mechanism for registration and implementation of TDS/TCS provisions remain suspended till 31 March 2018.

Conclusion

The economic leverage hoped by taxpayers in the long run is keeping them optimistic about the new regime. The large corporate houses have more or less equipped themselves to be GST ready and small taxpayers are coping up.

Digital India is the most celebrated agenda of the Government of India; however, it has ended up in creation of additional trade barriers for e-commerce operators under GST. In this regard, it is yet to be seen whether GST is able to keep harmonious balance between offline and online vendors including e-commerce operators and help them to achieve organized and all-inclusive growth.

GST and e-commerce trade both have the potential to disrupt the market in the most positive way, given that the attitude of the stakeholders is towards acceptance and adaptability.

Note – Please note that the above article is for education purpose only. This is based on our interpretation of laws which may differ person to person. Readers are expected to verify the facts and laws.

join For Updates

join For Updates