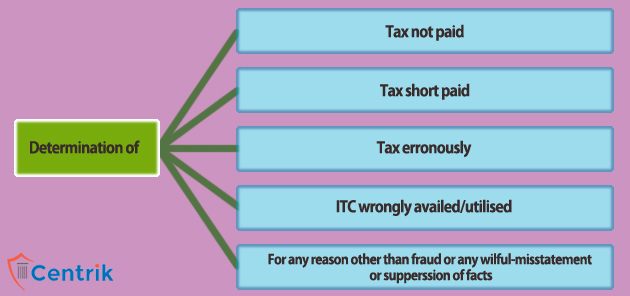

To recover any tax not paid inadvertently, GST provides for various provisions whereby a proper officer can demand and recover such amount of tax along with interest and penalty. Section 73 states that under the following circumstances a proper officer can serve a show cause notice for recovery of tax along with interest or penalty applicable.

The Act further specifies that if a Show Cause Notice(SCN) was previously issued on same grounds for earlier period, a proper officer can issue a statement instead of a show cause notice containing the details of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilised for such periods.

Payment of Tax before SCN

A person chargeable to tax can on the basis of his own ascertainment pay tax along-with interest payable thereon under section 50, before service of SCN or statement as the case may be. But if the amount paid by such person is falling short of the amount actually payable, the proper officer may issue a SCN in respect of the amount falling short. If the tax along with the interest is paid within 30 days of SCN, no penalty will be levied and all proceedings in respect of the said notice shall be deemed to be concluded.

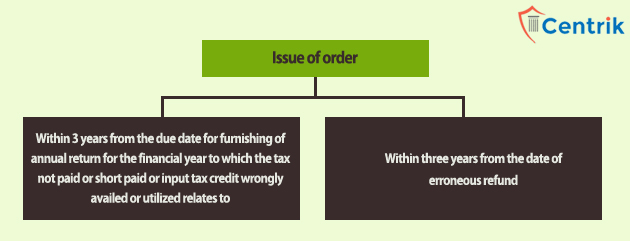

The proper officer shall, after considering the representation, if any, made by person chargeable with tax, determine the amount of tax, interest and a penalty equivalent to ten per cent, of tax or ten thousand rupees, whichever is higher, due from such person and issue an order.

Note – Please note that the above article is part of our continuous research on the related matters. It is based on our interpretation of related regulations which may differ person to person. Readers are expected to take expert opinion before relying on above.

join For Updates

join For Updates