Normally, Seller Collects GST from buyer and pays to Government. However, in some cases, buyer pays GST directly to Government, This is called Reverse Charge in GST

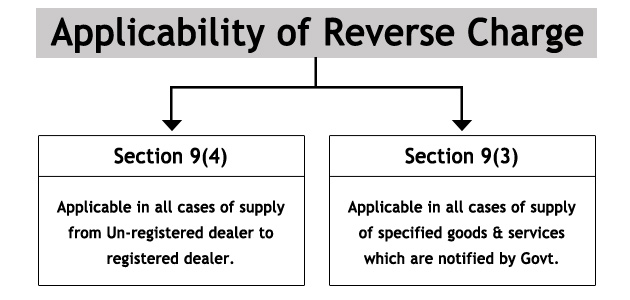

There are two types of reverse charge scenarios provided in law.

- It is dependent on the nature of supply and/or nature of supplier. This scenario is covered by section 9 (3) of the CGST Act and section 5 (3) of the IGST Act.

- It is covered by section 9 (4) of the CGST Act, 2017 and section 5 (4) of the IGST Act where taxable supplies by any unregistered person to a registered person is covered.

Example

Suppose A provides Service to B of 100000+GST 18000

In this case, B will pay A Rs 118000 and deposit to Government

However, in Case of Reverse Charge,

A will provide Service to B of 100000

In this case, B will pay A Rs 100000 and deposit remaining directly to Government

GST in Case of Goods Earlier Reverse Charge was applicable in Case of Services only (in Service Tax).It was not applicable in case of Goods (There was no reverse charge concept in Vat)

It was not applicable in case of Goods (There was no reverse charge concept in Vat).However, now in GST, it is applicable in Goods Also

However, now in GST, it is applicable in Goods Also

Example

X Sold Goods to B of Rs 100000 Suppose GST Rate is 5%

Suppose GST Rate is 5%In this case, X will sell goods to Y for Rs 100000 + GST 5% = 105000

In this case, X will sell goods to Y for Rs 100000 + GST 5% = 105000

Y will pay X Rs 105000 and X will pay 5000 to Government

However, If X is Unregistered in GST, then X cannot charge GST on it Then Reverse Charge will also be applicable on it

Y will pay X 100000 and deposit 5000 Directly to Government

Registration

A person who is required to pay tax under reverse charge has to compulsorily register under GST and the threshold limit of Rs. 20 lakhs (Rs. 10 lakhs for special category states except J & K) is not applicable to him.

When is GST Reverse Charge Mechanism applicable?

Reverse Charge under Section 9(4) – Supply from Unregistered to Registered Person

If a person not registered under GST supplies Goods or Services to a person who is registered under GST, then in such cases – Reverse Charge Mechanism would get applicable i.e. the GST would be required to be paid by the Registered Person directly to the Govt. on behalf of the supplier.

However, in case of supply of exempt goods or services, GST under Reverse Charge Mechanism shall not be applicable. This can be explained with the help of an example.

Example: A registered person hires an Auto Rickshaw for commuting from one place to another, then in such cases – Section 9(4) would not be applicable since the transportation of passenger by auto rickshaw is an exempted service.

It is pertinent to note here that the provisions of Reverse Charge under Section 9(4) are applicable only for supplies within the same state. The provisions of Reverse Charge under this Section are not applicable to Inter-state supplies as inter-state supplies cannot be made by unregistered suppliers.

Reverse Charge u/s 9(3) of CGST Act, 2017 – Goods & Services notified by Govt. for levy of Reverse Charge Mechanism

Reverse Charge Mechanism is also applicable on certain goods and services which are notified by the Govt. Reverse Charge under Section 9(3) are applicable for both inter-state as well as same state transactions. The goods and services on which GST shall be levied under the Reverse Charge Mechanism are such as tobacco leaves, silk yarn, and supply of lottery, cashew nuts not shelled or peeled.

Reverse Charge on Services u/s 9(3) of CGST Act, 2017

The Services on which GST shall be levied under Reverse Charge are such as any service supplied by any person who is located in a non-taxable territory, supply of services by a Goods Transport Agency (GTA) etc.

OTHER CRUCIAL POINTS REGARDING LEVY OF REVERSE CHARGE MECHANISM (RCM)

- All persons procuring goods or services notified u/s 9(3) or section 9(4) of the CGST Act, 2017 are mandatorily required to obtain GST Registration.

- GST levied under the Reverse Charge mechanism should be deposited with the Govt. by the 20th of the next month.

- GST paid under the Reverse Charge mechanism would be available for Input Tax Credit if such goods and/or services are used in the furtherance of business. The service recipient (i.e. who pays reverse charge) can avail input tax credit.

- The details of GST paid under Reverse Charge Mechanism (RCM) would not be auto-populated in the GSTR 2 and these details would be required to be manually furnished.

- In cases where RCM is levied, the recipient shall raise an Invoice on self. Invoice shall be issued on a daily basis for all consolidated purchases made during the day on which GST is levied under Reverse Charge.

- At the time of payment to the supplier, the recipient shall also issue a payment voucher for the payment made.

- Input Tax Credit with the recipient cannot be used for payment of Reverse Charge to the Govt.

- A registered person will not lose input tax credit of GST paid under Reverse Charge even if the payment is not made within 180 days.

- Reverse Charge is also applicable to recipients registered under the Composition Scheme. No Credit of RCM is available in such cases.

- RCM is levied on advance payments as well.

Note – Please note that the above article is for education purpose only. This is based on our interpretation of laws which may differ person to person. Readers are expected to verify the facts and laws.

join For Updates

join For Updates