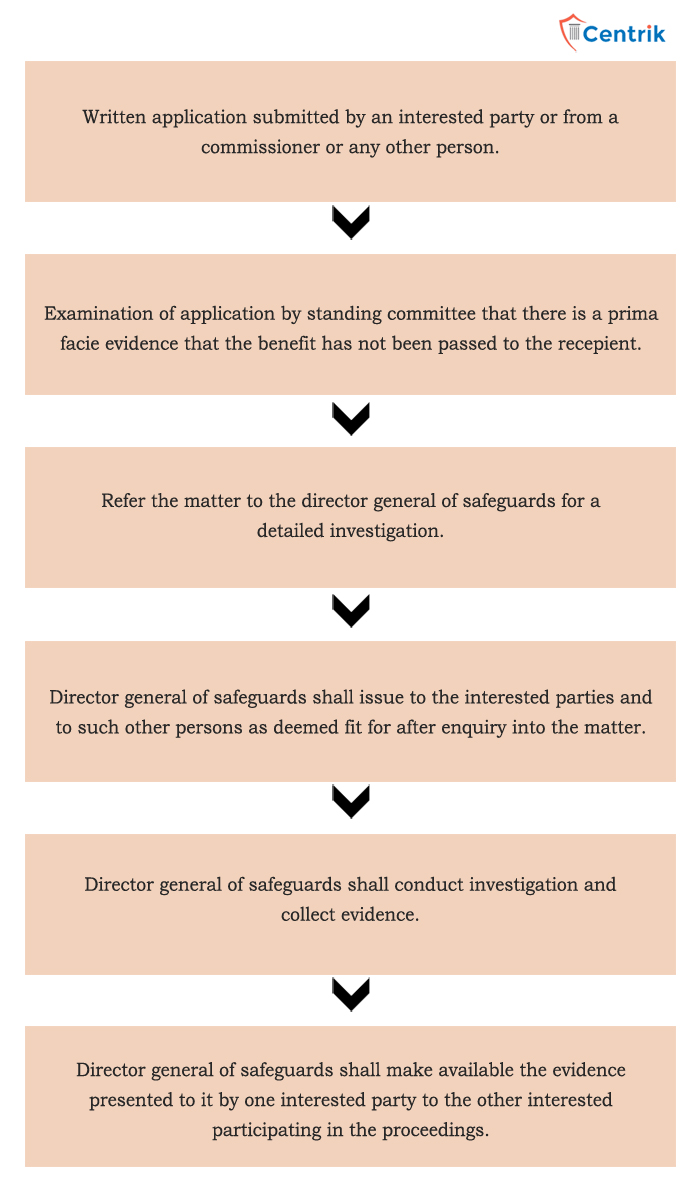

Although the Authority has the power to decide the methodology and procedure for determination as to whether the reduction in the rate of tax on the supply of goods or services or the benefit of input tax credit has been passed on by the registered person to the recipient by way of commensurate reduction in prices, Anti Profiteering Rules prescribe the following procedure.

Written application submitted by an interested party or from a Commissioner or any other person.

The Director General of Safeguards shall complete the investigation within a period of three months of the receipt of the reference from the Standing Committee or within such extended period not exceeding a further period of three months for reasons to be recorded in writing as allowed by the Standing Committee and, upon completion of the investigation, furnish to the Authority, a report of its findings along with the relevant records

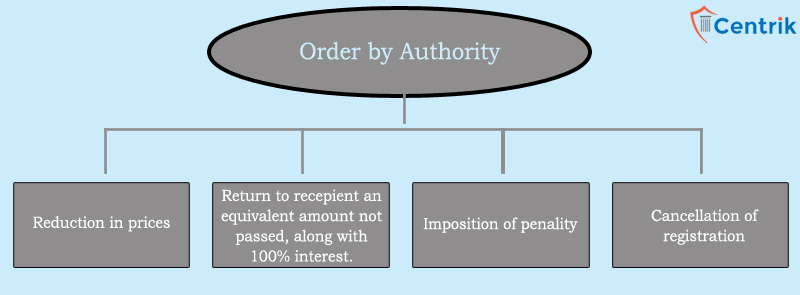

Where the Authority determines, within a period of three months from the date of the receipt of the report from the Director General of Safeguards, that a registered person has not passed on the benefit of the reduction in the rate of tax on the supply of goods or services or the benefit of input tax credit to the recipient by way of commensurate reduction in prices, the Authority may order.

Note – Please note that the above article is part of our continuous research on the related matters. It is based on our interpretation of related regulations which may differ person to person. Readers are expected to take expert opinion before relying on above.

join For Updates

join For Updates